In addition to creating the bill to actually record paying your sales/use tax, there’s an adjusting entry you might want to create for that sales tax period so that your Sales general ledger balance doesn’t include sales tax in it.

Why is this necessary in the first place? First, your financial statements are correct. However, in order to simplify accommodating and accounting for the sales and use tax for all 50 states, the QFloors software includes the sales tax amount when it posts to the Sales general ledger account. For example, if a sale subtotal is $1,000.00, and the sales tax is $78.50, therefore the total is $1,078.50, QFloors posts the full $1,078.50 to the Sales account, not just the $1,000.00. In accounting language, that posting is a “credit” entry. The offsetting “debit” is posted to the Sales/Use Tax Expense account. Follow the steps below to remove the sales tax amount from the Sales account and also from the Sales/Use Tax Expense account.

As mentioned above, your financial statements are correct because the Sales account includes the tax in it, so Revenue shows higher, but the tax is also posted to Sales/Use Tax Expense account, which reduces overall net income. So you could leave everything as it is, but here’s what you need to do if you want to adjust the sales tax out of the two accounts.

First, watch the webinar and training videos on our website so that you know all the other aspects of sales and use tax in the QFloors software.

Sales/Use Tax

Basic Training Part 2

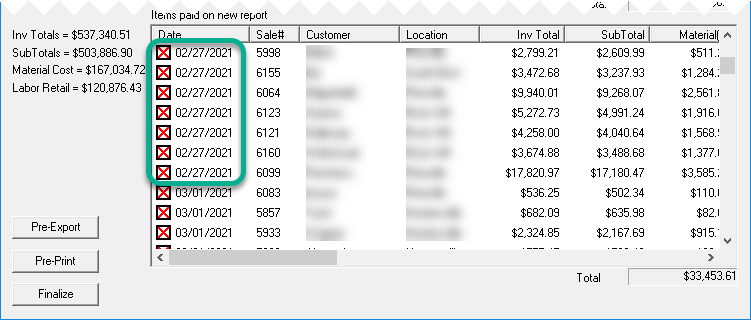

Next, before finalizing your sales tax report, see if there are any sale lines that are dated in prior periods as in the image below. If there are, you’ll need to make an adjustment to those prior months as well as the sales tax month you’re working on.

You should not have that situation. If you do, it’s

most likely because you’re not closing the general journal

monthly. Please carefully read and follow the instructions

in our Knowledge Base article,

Close Period - Closing the General Journal.

After finalizing your sales tax report,

-

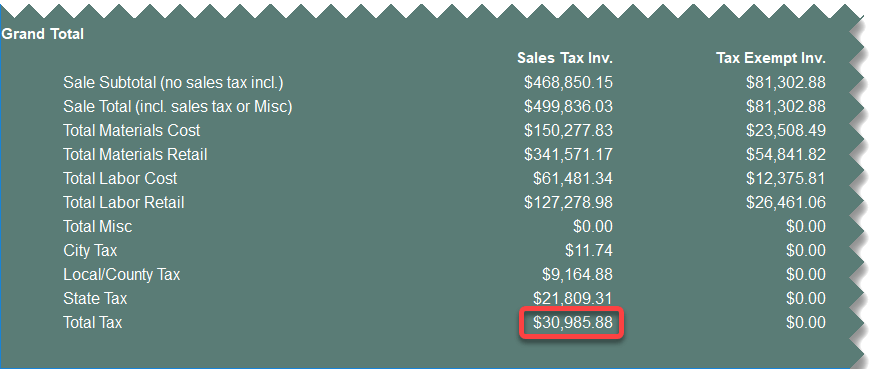

If you did not have sales from prior periods included,

then scroll to the Grand Total section at the bottom of

the first page of the report (the Location Summary page)

and get the Total Tax amount from the Sales Tax Inv

column.

-

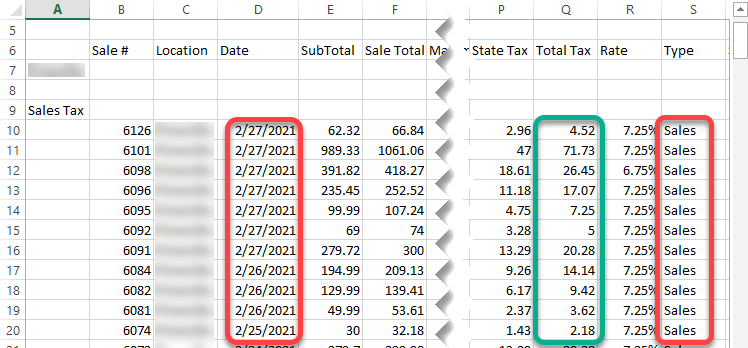

If you did have sales from prior periods included, select

the Detail option at the top right of the report, then

export that detail report. Open that CSV file in a

spreadsheet program then group and sort all of the data

where the Type is “Sales” to get the Total Tax amount for

each monthly period.

To create the journal entry adjustment, follow the instructions in our Knowledge Base article, How to Create a Journal Entry.

Date the entry for the last day of the month, and use the amount(s) you obtained from one of the two bullet points above. You need to debit the Sales account (a positive amount) and credit the Sales/Use Tax Expense account (a negative amount). NOTE: If your sales tax report has sales data in a prior fiscal year, and you have already submitted financial reports to your accountant for that year’s tax return preparation, talk with your accountant before making an adjustment dated in that year. If your sales tax report has sales data in a prior fiscal year, and your income tax return has already been filed, don’t make any adjustments dated in that year.

As always, please email or call our Support team if you have any questions, and thank you for using QFloors!

Sincerely,

Ron Cluff

Director of Training