This has been a rollercoaster of a year hasn’t it? At the beginning of 2020, the economy in all areas of the country was humming along and most businesses were doing well. When Covid hit and governments shut down huge parts of our economy, many business owners were afraid for a few months if they could survive a shut down for long. Now, instead of asking what they should do to survive, they have started to ask about how to deal with their success:

“What should I do with my profits?”

“My business is growing, sales and profits are increasing. What should I do next and when should I do it?”

“What should I do with my extra cash?”

The answers to these questions? It depends on what your goals are. Some want to just put away as much cash as they can for the next rainy day or for retirement. Most owners, however, want to expand and make their business more valuable, either for themselves or to sell to someone else. Prior to embarking on either route, make sure you have built a solid foundation. Here’s how:

- Pay yourself, your employees, and your installers the deserved raises, bonuses and benefits that you necessarily delayed during the dip. Finding and keeping good employees, especially sales managers and salespeople, is the most critical success factor in our businesses. Increasingly, the most important human resource for a growing contractor business like ours is our installers. If you are more than 3 weeks out on your installation schedule, this is a bottleneck in your business and you won’t be able to grow much bigger--despite your planned investments--without rectifying this situation first.

- Prepare your business to survive the next downturn by paying off or getting out of bad loans. Bad loans and too much debt contributed to the failure of roughly 25% of floor covering businesses in the last recession. Get out of bad debt while the getting is good. What’s a bad loan? It’s any loan with high interest rates or variable interest rates. Credit card debt is the worst kind. You should be paying your credit cards off every month. Interest rates will have to rise within the next few years.

- Pay down your credit lines (they have variable rates), and pay them off completely if you can. You’ll need room on the credit line if/when the next recession hits. You can’t assume sales volume and profit margins will stay the same or get better indefinitely.

- Consider paying off equipment and car loans. Use cash to pay for the new ones if possible, while avoiding leases. The lower your monthly payments, the more flexibility you will have to effectively use your working capital to safely and methodically expand your business.

Don't skip these steps. This is the necessary foundation you need from which to launch your expansion. If it takes several more years to find and train the right people and get rid of the bad loans, then use whatever time it takes.

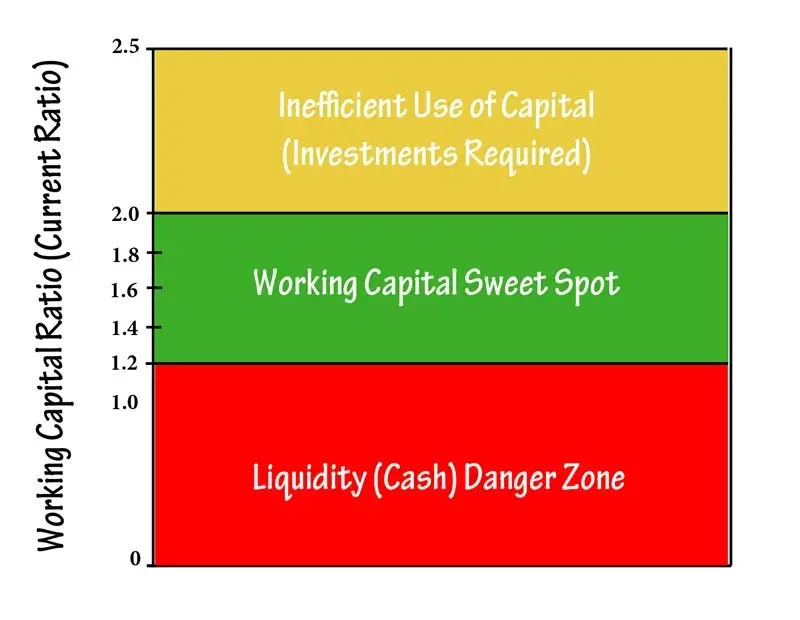

Now, look at your current ratio (sometimes called working capital ratio) on your balance sheet. This is calculated by taking total current assets and dividing that by total current liabilities (current assets/current liabilities). An efficient business should be somewhere between 1.2 to 2.0.

If it’s lower than 1, it means your current assets are lower than your current liabilities and you’re probably struggling to pay your immediate bills, let alone having the cash to make important investments in order to expand. If your ratio is over 2, then you’re not using your available working capital effectively and you certainly could and should be expanding/investing faster than you are

On the other hand, if your ratio is slightly above 1.2, you can’t go out and buy anything you want. You should only consider investing in things that, after the investment, don’t drop your ratio significantly below 1.2. Remember, when you invest in equipment, software, real estate etc., you are converting cash (a current asset) to a fixed asset. This will lower your current ratio immediately. Any working capital ratio above 1.5 means you’re definitely ready to expand--if that is your goal.

Next, evaluate and upgrade the assets/equipment that will help you run efficiently. Items such as computers and software, cutting machines and forklifts, delivery trucks and trailers would fall into this category. Can you increase your capacity with the assets you already have in place or do you need upgrades in this area? Again, avoid borrowing and try to pay cash for these things if you can. If your current ratio is 1.5 or more, then you should have plenty of cash to buy the necessary equipment needed. If you don’t have enough cash, then you probably have a receivables problem and/or an inventory problem.

Here are some of the other areas of expansion that owners usually focus on, often prematurely. All store owners want to sell more and make more profit, right? Most try to do this by getting business from sources that don’t necessarily physically walk into their stores (think builders, property managers, commercial). These categories of additional business revenue will increase profit dollars, but they will also use a lot of cash by way of higher receivables. Remember the role bad receivables played on business failure in the last recession? Make sure that no customer ‒ should they not pay their bill – has the ability to cripple your business.

Another enticing expansion investment for owners is inventory, for its ability to increase both profit margins and product volume. It’s true there are great deals out there if you buy rolls, truckloads, and containers; however, by doing so, you may be gobbling up the cash you need for other expansion investments. The industry average for inventory turnover (annual sales/average inventory) in the last few years was 6.1. If your operation is below this level, then you probably have too much inventory.

If and when you: 1) feel like you have the right people (human capital); 2) have eliminated your bad/unnecessary loans; and 3) your working capital ratio is above 1.2 and you have extra cash, then you may be ready to expand your business by adding equipment or locations or both. Using a similar model to the one that made you successful in your current location can work in another. It should be especially profitable with the management and back office economies of scale you gain with more locations.

Moreover, with a balance sheet such as I have described, you can obtain financing to purchase real estate (instead of just renting) if you so choose. Over the long run, it’s better to own than to rent. A down payment on real estate will require 20% of the total price, so plan your cash outlay so as not to make your current ratio go below danger levels. You can get a Small Business Association (SBA) loan with only 10% down, but keep in mind that a big part of the SBA loan (the bank’s portion) will likely be subject to variable interest rates. So, be careful with these.

Finally, having healthy levels of working capital will give your business financial stability while providing expansion options to take advantage of specific opportunities, such as necessary equipment, inventory, or real estate. Don’t take shortcuts. If you do, you put your planned expansion and your business itself at risk.